december child tax credit 1800

Staff Report November 10 2021 214 PM. Also up to 3600 will be sent for each child under the age of six and up to 3000 for each child between the ages of six and 17 if they did not receive previous payments issued since July.

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Families that qualify for the child tax credit will get at least half of their total return this year 1800 per kid under the age of 6 or 1000 each child from 6 to 17 years.

. Those who were able to use it in time will get 1800 for each child age under six and 1500 for kids aged six to 17. Child tax credit money will be delivered to qualified parents with their 2021 tax refunds even though monthly advance payments terminated in December. For example if you have two children under age six you would get 3600.

Payments worth up to 300 per month have been being sent since July bringing the total to a possible 1800 per child by December. Eligible families will receive up to 1800 in cash through December however the tax credit has a wrinkle that may prompt some families to bypass the federal program. The families that can get up to 1800 per child on Dec.

Ad File a free federal return now to claim your child tax credit. This includes up to 1800 per child under 6 or 1500 per child 6-17 or up to 3600 per child under. So who can get 1800 per child this month.

To qualify for the full payments couples need to make less than 150000 and single parents who file as heads of households need to make under 112500. See how USAFacts is a non-partisan non-partisan source of the facts. To opt out you need to do so by tomorrow Thursday Nov.

The amount you are paid in a lump sum this year depends on what you qualified for and received between July and December last year. Since payments have been going out since July that would mean. The deadline to file a simplified return and sign up for CTC payments is November 15.

So for example if. While the monthly advance payments ended in December the tax season 2022 distribute the remaining Child Tax Credit money to eligible parents along with their 2021 tax refunds. Typically families get up 300 per child - but some will get more this month.

500 Credit for Other Dependents are available who. Families who sign up will normally receive half of their total Child Tax Credit on December 15 according to the IRS. The payment could be as much as 1800 for each child five years old or younger and up to 1500 for each child 6 to 17 years of age.

Deadlines for opting in and out of the child tax credit payments are approaching fast. Ad USAFacts is a non-partisan non-partisan source of unbiased data. And if you have one child under six and one six to 17 you would get 3300.

However the deadline to apply for the child tax credit payment passed on. How Much Am I Entitled To. That means a.

Low-income families who signed up before the November 15 deadline will receive all the money they are owed in the December 15 payout according to the Internal Revenue Service. Child Tax Credit. Parents can expect more money to come from expanded child tax credit This year.

If you and your family meet the income eligibility requirements and you received each payment between July and December last year you can expect. Its possible to get 1800 for the December child tax credit payment heres how. Parents can receive up to 1800 for every child under the age of five and 1500 each for children between 6 and 17.

This means a family can get a payment of up to 1800 for each child under 6 or up to 1500 per child over 6 in time for Christmas. Typically qualifying families receive up to 300 per child per month. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17.

Those who signed up will receive half of their total child tax credit payment up to 1800 as a lump sum in December. The new advance Child Tax Credit is based on your previously filed tax return. This means a payment of up to 1800 for each child under 6 and up to 1500 for each child ages 6 to 17.

Families who receive advance payments of the child tax credit. The check will be sent with a value of up to 1800 per dependent who is five years old or younger or up to 1500 for each child between the ages of six and 17.

Unemployment Benefits And Child Tax Credit H R Block

Nta Blog Advance Child Tax Credit What You Should Know Part Ii Tas

The Romney Child Allowance Is Good People S Policy Project

Child Tax Credit Brought To You By Providers

The Romney Child Allowance Is Good People S Policy Project

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

Advance Child Tax Credit Payments Learn If You Need To Pay Money Back Cnet

December Child Tax Credit What To Do If It Doesn T Show Up Abc10 Com

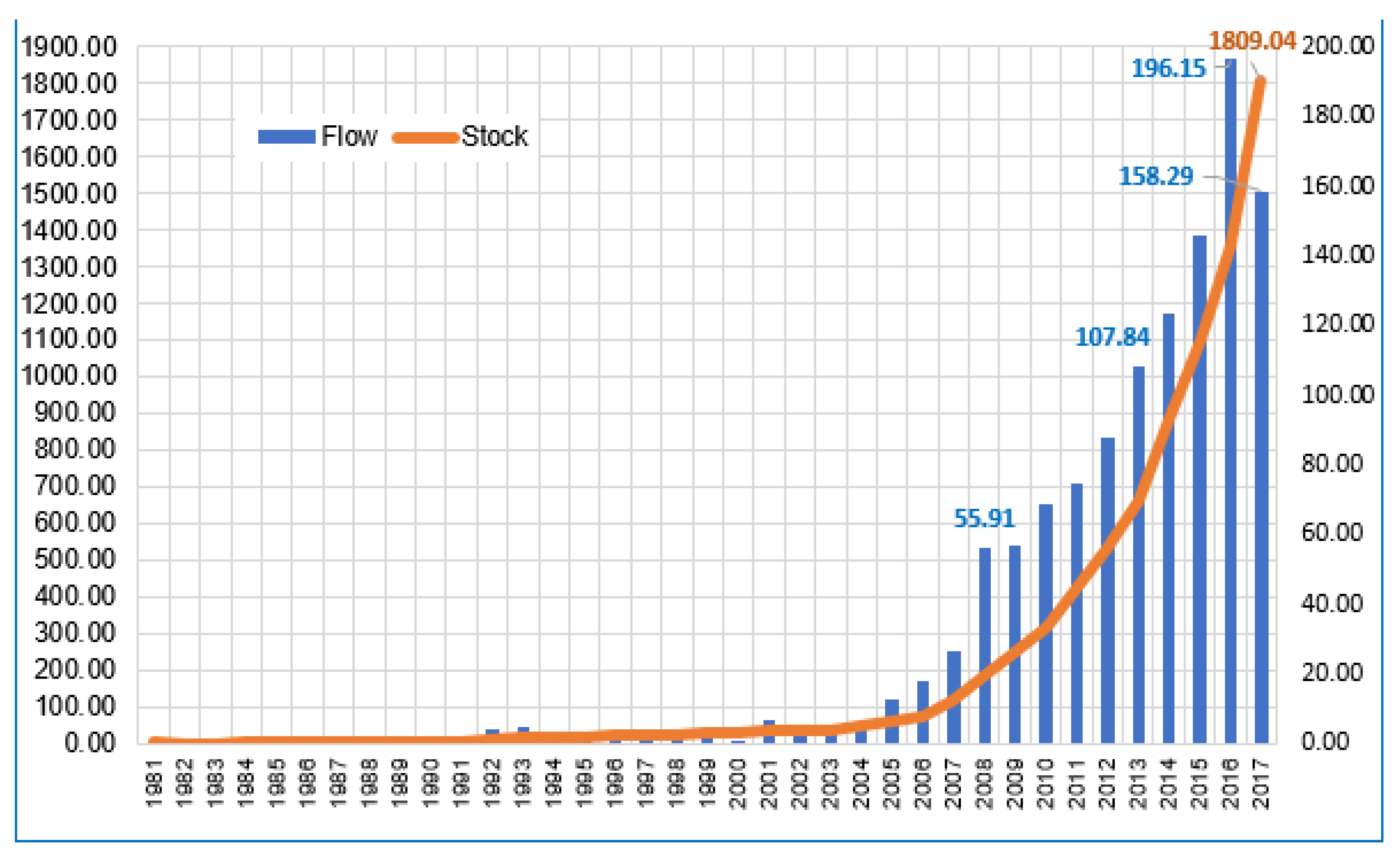

Sustainability Free Full Text Natural Resources And Foreign Direct Investment In Africa Evidence From Chinese Firms Html

What Are Monthly Advance Child Tax Credit Payments

Child Tax Credit Here S When You Ll Get The August Payment Cbs News

Child Tax Credit Brought To You By Providers

Mendez Mendez Tax Service Facebook

The Tax Cuts And Jobs Act Searching For Supply Side Effects National Tax Journal Vol 74 No 4

Child Tax Credit Brought To You By Providers

What Are Monthly Advance Child Tax Credit Payments

Padden Cooper Cpa S Remember That The Child Tax Credit Is Optional If You Request It Now You Cannot Claim It Later On Your Taxes For More Help Call 609 953 1400 Childtaxcredits Taxes